What is a Charitable Remainder Trust?

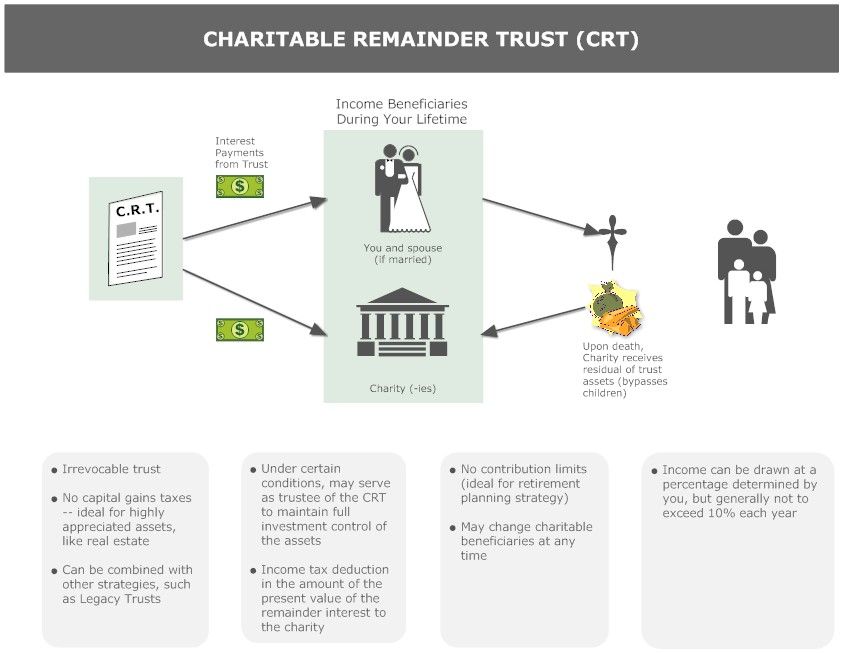

Charitable remainder trusts are the classic planned gift. They enable the donor(s) to make an irrevocable gift to charity today, receive current income and gift tax deductions, remove the property from the donor’s taxable estate, and to continue to enjoy income from the gifted property for life, multiple lives, or a predetermined number of years.

These trusts are tax-exempt entities. Income and gains realized by charitable remainder trusts are tax-free. As such, they provide an excellent opportunity to give substantial wealth back to the community, and at the same time realize appreciation on contributed assets, reinvest the proceeds undiminished by income taxes, and receive income from those new investments. Upon the death of the income beneficiaries, the trust assets are distributed to the designated charities. Properly structured, the distribution to the lifetime beneficiaries of charitable remainder trusts may be postponed from the date of the gift to some predetermined time.

The income stream to the donors or their appointed beneficiaries may be fixed (charitable remainder annuity trusts), or may vary with the annual value in income of the trust (charitable remainder unitrusts). When coupled with wealth replacement trusts funded with life insurance, charitable remainder trusts can significantly diminish or eliminate estate tax liabilities while leaving surviving family members the same wealth they would have otherwise enjoyed from one’s estate.

Charitable remainder trusts are subject to some of the provisions applicable to private foundations. Under these rules, the governing instrument must include provisions prohibiting self-dealing and taxable expenditures.

These gifts are most appropriate for those individuals who can part with some or all of their assets during their lifetimes knowing that their financial needs are covered, in part or fully, by the income stream from these trusts.